What a POS terminal is

A Point of Sale (POS) terminal is a device used to authorize and process payments made with credit or debit cards at retail points. Credit and debit card information is stored in the magnetic stripe of the credit or debit card. When you swipe your credit or debit card at a point of sale terminal, the card’s magnetic stripe is read by the terminal and information about you and your account is transmitted to the merchant’s bank. The bank then processes payment on behalf of the merchant through an electronic funds transfer (EFT). The bank may also verify that the card has not been reported stolen. The merchant receives an approval or denial of your transaction, and you are notified by text or email with a receipt for your purchase. In reality, this process is quite complex. The merchant’s bank must send the transaction information to your bank—which may then route it through a host of other banks and networks before reaching your financial institution. Once the transaction reaches your bank, it must be processed and approved.

The future POS system will include proprietary or third-party portable devices, as well as contactless features for emerging forms of mobile payments. The POS system will also be able to support multiple payment options, including debit and credit cards, as well as other forms of payment like mobile wallets.

How a POS terminal works

When using credit or debit cards for payment, traditional point of sale (POS) terminals first make sure there are sufficient funds in the account by reading the magnetic stripe on the card. When a sale is completed, the transaction is recorded and either printed or sent to the buyer via email or text message. The problem with this method is that it can be slow, especially if the POS system is not connected to the internet. Many times, customers are forced to wait several minutes while the terminal verifies their payment information. More importantly, it leaves merchants susceptible to fraud. This is because the customer has all the information they need to make purchases before they even arrive at the store. This makes it easy for fraudsters to create fake cards and use them to steal money from merchants. Blockchain technology solves this problem by eliminating the need for a middleman (i.e., credit card company) in transaction processing, which means there is no longer any personal data stored on servers that can be hacked into.

Merchants can decide whether they want to purchase or rent POS terminals, depending on their personal preference. Leasing a system has the advantage of distributing high up-front costs over time, but it may end up costing more in total than purchasing the same system outright. POS terminal rental is an excellent option for merchants who do not have a high volume of sales and/or transactions. This can help to save on the cost of purchasing a system upfront, as well as provide flexibility in case the business needs to move to another location or expand its operations over time. POS terminal rental is also a good option for businesses that want to try out the technology before making a large investment. The monthly cost of leasing is typically lower than purchasing, so it could be an effective way to determine whether a POS system will make sense for your business before deciding whether to purchase it outright. Purchasing a POS system outright can be less expensive than leasing, but there are some benefits to leasing. For example, if you need to move or close your business, you may not have to worry about selling or disposing of the equipment. In addition, leasing typically allows for software upgrades that improve functionality and add features over time.

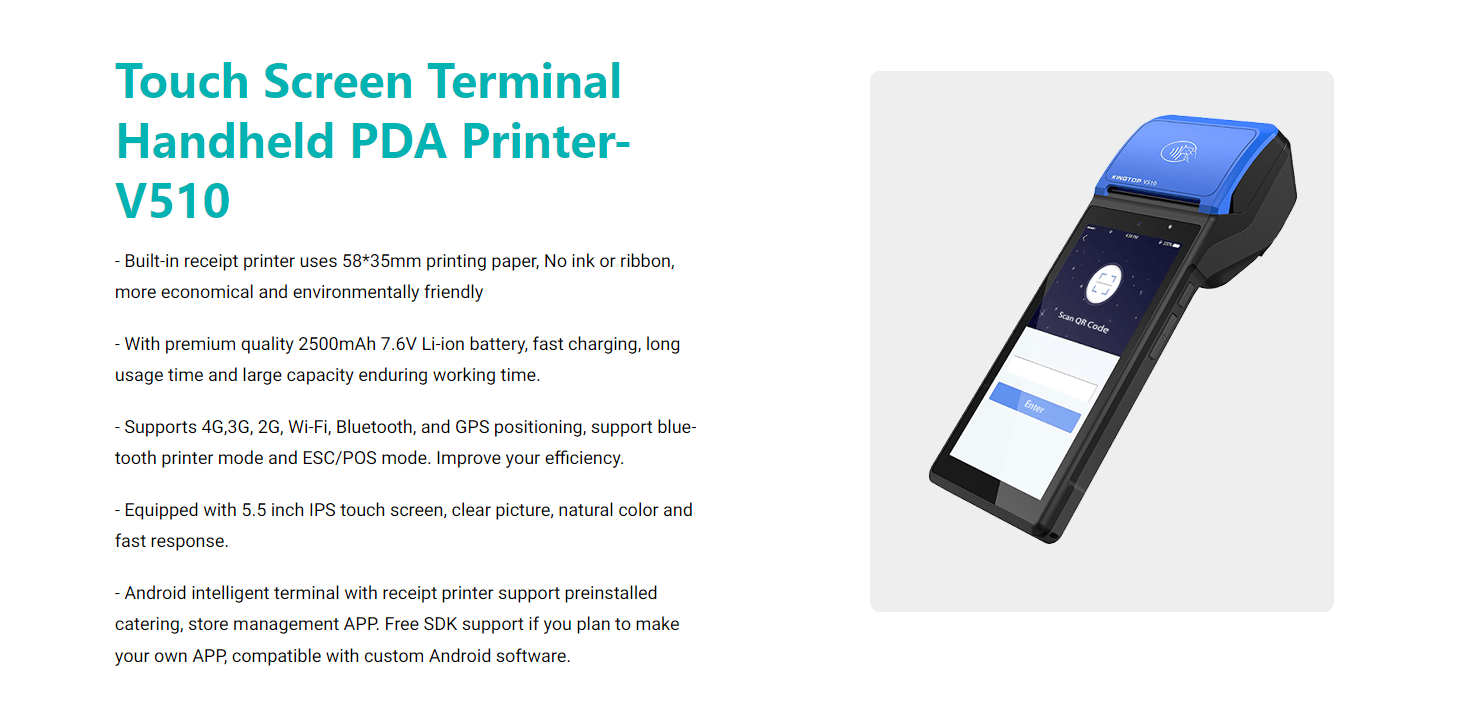

More and more businesses are choosing to rely on software for their point-of-sale applications, which can easily be downloaded onto tablets or other mobile devices. In order to remain competitive, POS terminal manufacturers are producing portable and mobile point-of-sale devices. And many touch screen POS terminal suppliers have also made some efforts to occupy the market. These touch screen POS terminal suppliers aim to provide better use experience for customers. The reason for this is that the demand for portable POS terminals has increased over the last few years. In fact, many businesses have started to rely more on mobile point-of-sale devices since they can easily be transported from place to place. This makes it easier for companies to provide a wider range of services without having to hire additional staff members.

Remember to choose a secure POS system

This device, which can be seen in busy retail stores and restaurants, is used to speed up waiting times for customers who don’t want to spend their time as they pay. Buyers of POS systems consider price, functionality and user friendliness when making their purchasing decision. In today's increasingly connected world, security is a key concern for all businesses. High-profile customer data breaches have occurred through POS terminals despite not having updated operating systems. This is why it's important to choose a POS system that is fully secure and comes with an updated security system. A POS system should also be easy to use so that employees can easily learn how to use it, which will save time for businesses. Your business needs a POS system that meets your specific needs, whether you're looking for something simple or complex. The best way to choose a POS system is by looking at your business's needs and then finding a solution that fits those needs. You should also consider the future growth of your company, as some systems can be expanded or upgraded with additional hardware.

French

French German

German Arabic

Arabic Italian

Italian Spanish

Spanish Japanese

Japanese Persian

Persian Korean

Korean Chinese (Simplified)

Chinese (Simplified)