POS terminals are commonplace in retail, but they can also make an appearance at any type of business. Basically, they take your payment card information and allow you to finalize your transactions. These devices are very common in major chains like Target, Wal-mart and CVS where credit card payments are the norm. In smaller shops and restaurants, there is usually a cash register or register that does everything for you except taking your money.

The purpose of a POS terminal

A POS terminal is an electronic device that is used to process payments. It is usually located at a checkout counter of a retail store or restaurant, and it allows customers to make purchases by entering their credit/debit card information as well as other personal information such as their address and phone number.The purpose of a POS terminal is to enable retailers to accept payments from customers via debit or credit cards. This gives them the ability to accept payment for inventory sold at their store, which increases their sales volume and profitability.In addition, POS terminals come in different varieties depending on their purpose and features. For example, some POS terminals are equipped with cash registers that can record sales transactions automatically; others have keypads that allow customers to enter their payment details manually; and still others offer both options.

Components of a POS terminal

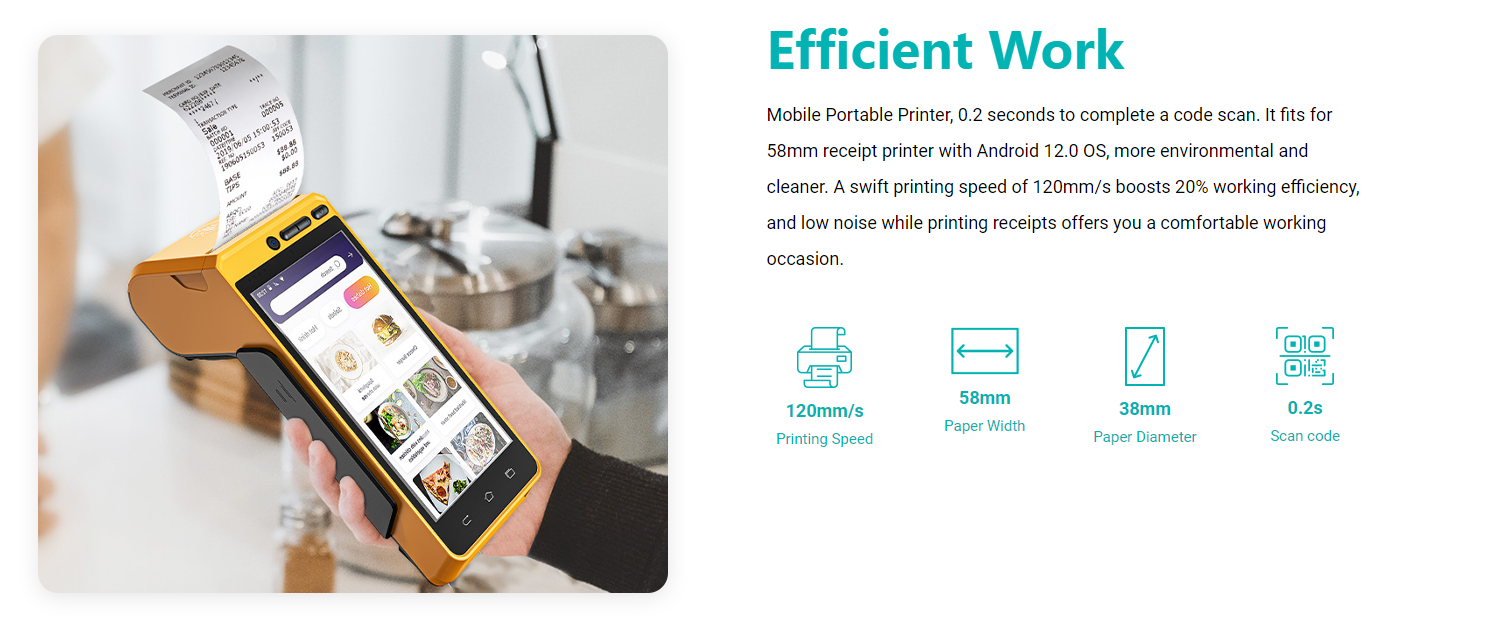

A POS terminal consists of several key components that work together to ensure seamless transactions. It processes the data received from other components and executes the necessary commands. The CPU is usually accompanied by a touchscreen display, which allows the cashier or customer to interact with the terminal easily.

Another essential component is the card reader, which reads the customer's payment card information, such as credit or debit card details. The card reader may be integrated into the terminal or connected externally. Additionally, a receipt printer is included to provide customers with a physical copy of their transaction details. Some POS terminals also feature a cash drawer for storing cash received from customers.

How does a POS terminal work?

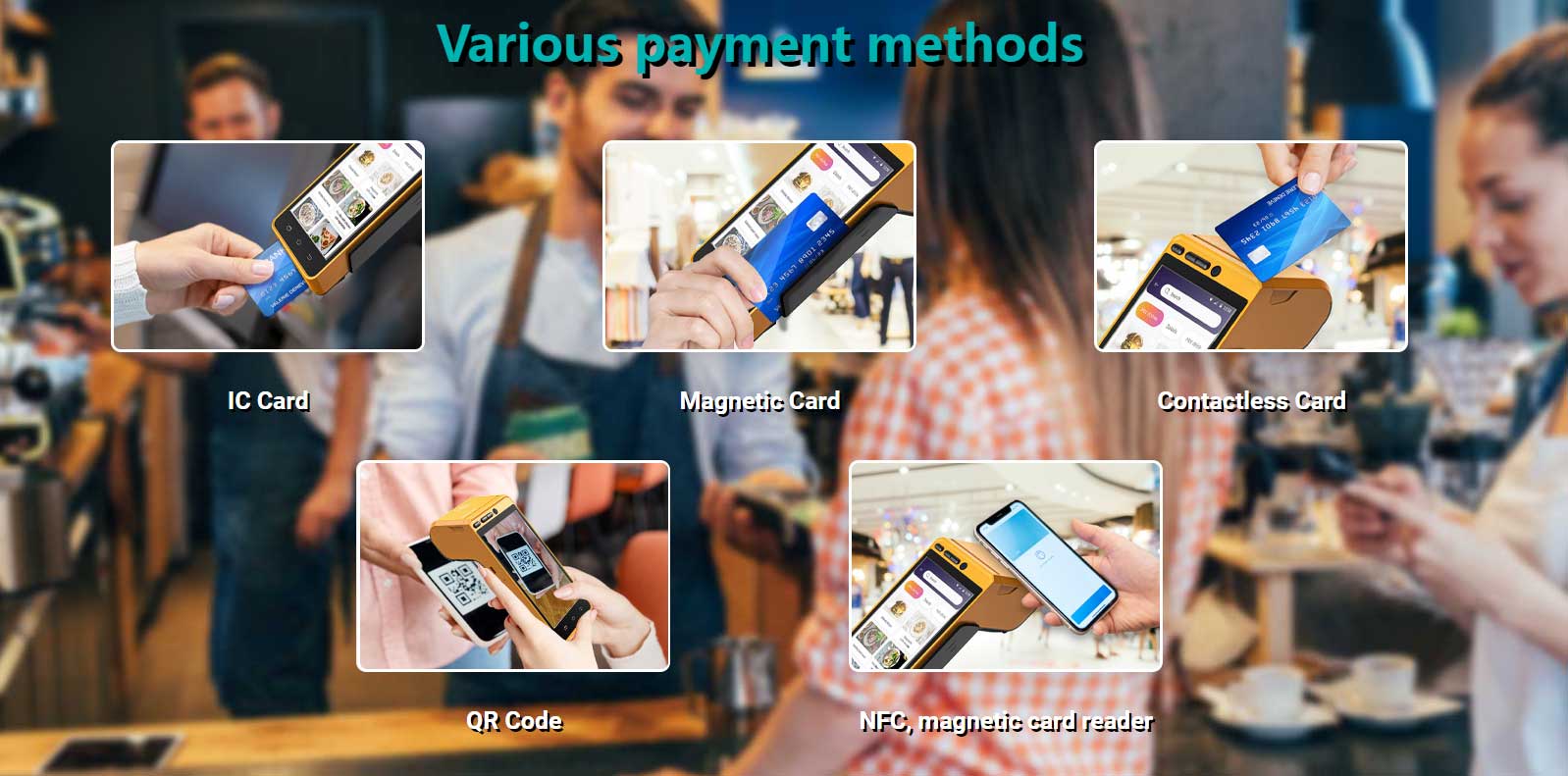

Now that we understand the components of a POS terminal, let's explore how it actually works. When a customer is ready to make a purchase, the cashier or the customer themselves enters the sale details into the POS terminal. This includes the items or services being purchased and the quantity. The terminal then calculates the total amount owed, including any applicable taxes or discounts. To complete the transaction, the customer can choose their preferred payment method. If they opt to pay by card, they simply insert or swipe their payment card into the card reader. The terminal securely captures the card data and sends it to the payment processor for verification. Once the payment is authorized, the terminal prints a receipt for the customer and updates the inventory system, if integrated. In the case of cash payments, the cashier enters the amount received from the customer into the POS terminal. The terminal calculates the change owed and opens the cash drawer for the cashier to provide the appropriate amount.

Different types of POS terminals

POS terminals come in various forms to cater to different business needs. The most common types include countertop terminals, mobile terminals, and tablet-based terminals. Countertop terminals are stationary devices commonly found at the checkout counters of retail stores or restaurants. They offer robust functionality and are typically connected to a network for seamless communication with other systems.Mobile terminals, on the other hand, are portable devices that enable businesses to accept payments on the go. They are especially popular among food trucks, pop-up stores, and delivery services. Mobile terminals connect wirelessly to a network, allowing for flexibility and convenience.Tablet-based terminals combine the power of a traditional POS system with the mobility and user-friendly interface of a tablet. They are becoming increasingly popular in restaurants and cafes, as they offer a sleek and modern solution for order taking, payment processing, and inventory management.

Choosing the right POS terminal for your business

The POS terminal is a critical piece of the retail environment. It’s used by customers to enter their payment method, view their receipt, and manage their loyalty programs.As a business owner, you want to make sure the POS terminal you choose is the right one for your business. Here are some things to consider when choosing a new or upgraded POS terminal:

The first thing to look at when choosing a new or upgraded POS terminal is the hardware itself. The type of hardware will depend on what your business does and how many checks you expect to process per day. For example, if you run only one register at a time, then it doesn’t really matter whether it’s a cash register or not; but if you have multiple registers and you plan on processing multiple checks at once, then having something that can handle multiple transactions simultaneously would be beneficial.The second thing to consider when choosing a new or upgraded POS terminal is the software powering it. Every business has different requirements when it comes to software; however, there are some universal features that most businesses want in their software platform. A POS terminal is a computerized cash register, or point of sale device, that's used for accepting payments and processing sales.

POS terminals are also known as swipe machines

A Point of Sale (POS) terminal is a computerized device that accepts payments and verifies purchases. It can be found at retail stores, restaurants, banks, gas stations and anywhere else money is exchanged. The terminal's software is how the machine interacts with the customer to process transactions.The device has two main components: one for swiping credit cards and another for swiping debit cards. The credit card swipe accepts payment from customers and deducts it from their accounts; the debit card swipe accepts payment from customers' accounts and deducts it from the merchant's account.If you don't know what kind of devices are being used at your local grocery store, there's a good chance that you're missing out on valuable information about how they handle payments. For example, if you notice that most of the transactions involve credit cards and debit cards, then this indicates that card readers are being used instead of cash drawers.It's also important to know whether or not there are any limits on how much money can be withdrawn from these terminals at one time. Some businesses allow customers to withdraw large sums of money as quickly as they like — up to $250 or even more! Other stores only allow them to withdraw small amounts at a time — usually $100 or less per transaction.

Some POS terminals have cash drawers, and some don't

Cash drawers are a big deal for small businesses. They're expensive to install, but they make it easier for your customers to pay when you run low on cash and need to keep an eye on how much money is in your register.Some POS terminals have cash drawers, and some don't. There are a few reasons why you might want to choose a terminal that has one:You don't have many customers who pay with cash, so the drawer will be wasted space. If you have only one or two customers who pay in cash each day (or even just one), this is less of an issue than it would be if you had more than that.You want your employees to feel comfortable using the drawer because they won't be scared of accidentally making customers wait while they figure out how to use the machine.Some POS terminals have cash drawers, and some don't. The reason is that some vendors want their customers to use the terminal to make payments. Others may not want the ability to run off with the money stored in the drawer. This is a serious safety concern for every business owner, and it's one of the reasons why you should always make sure you know what devices are available at your local store.

Integrating a POS terminal with other systems

Integrating a POS terminal with other systems can bring significant advantages to your business. By connecting your POS terminal to your accounting software, you can automate tasks like updating sales data, generating financial reports, and reconciling transactions. This integration enables automatic updates to inventory levels when a sale is made, providing accurate insights into your stock availability. Additionally, it streamlines the process of generating purchase orders, as the system can automatically reorder items when stock reaches a certain threshold.

A POS terminal is a crucial tool for businesses in the retail and hospitality industries. It facilitates smooth and efficient transactions by capturing and processing payment information. By understanding the components and functionality of a POS terminal, businesses can make informed decisions when choosing the right system for their needs. Integrating the POS terminal with other systems further enhances efficiency and provides valuable insights into sales data. Embracing a POS terminal not only enhances the customer experience but also streamlines operations and helps businesses thrive in today's competitive market. So, consider implementing a POS terminal in your business and unlock its numerous benefits.

French

French German

German Arabic

Arabic Italian

Italian Spanish

Spanish Japanese

Japanese Persian

Persian Korean

Korean Chinese (Simplified)

Chinese (Simplified)