In the modern business landscape, point of sale (POS) terminals have become indispensable tools. These devices go beyond facilitating seamless transactions and offer a wide array of features that streamline operations and elevate the overall customer experience. With various types of POS terminals available, it's essential to grasp their distinctions and functionalities to make well-informed decisions. In this blog post, we'll explore the various types of POS terminals and help you choose the right one for your business.

Traditional Countertop POS Terminals

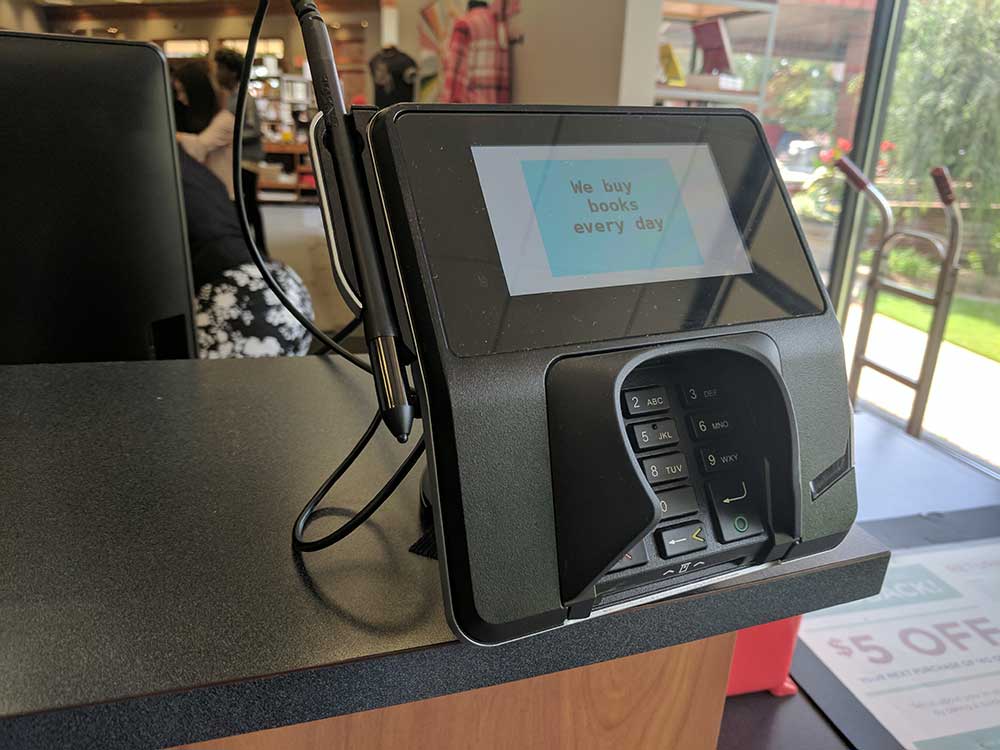

Countertop POS terminals have stood the test of time as a dependable and efficient solution for businesses that require a fixed checkout location. These terminals have become the backbone of many retail stores, restaurants, and salons due to their robust features and compatibility with various software and peripherals.

One of the defining characteristics of countertop POS terminals is their stationary nature. They are designed to be placed on the sales counter, allowing cashiers or staff to easily access and operate them. This setup promotes efficiency and a smooth checkout process, as customers can make their payments conveniently without the need to move around the store.

Countertop POS terminals typically consist of a screen, which displays the transaction details and prompts for input, whether through a physical keypad or a modern touchscreen interface. The screen provides a clear and user-friendly interface for cashiers to enter product information, select payment methods, and complete transactions swiftly.

Another essential component of countertop POS terminals is the receipt printer. After a successful transaction, these terminals can print physical receipts for customers, providing them with proof of purchase. Receipts provide comprehensive information, including itemized details of purchases, prices, taxes, and any applicable discounts. This feature promotes transparency and aids in record-keeping for both businesses and customers.

Durability is a key attribute of traditional countertop POS terminals. They are built to withstand the demands of a busy retail environment, with rugged construction and materials that can handle the wear and tear of daily use.The robustness of these terminals guarantees long-lasting performance and reduces the necessity for frequent repairs or replacements.

Countertop POS terminals also boast high processing power, allowing for speedy transaction processing. They possess the capability to handle intricate calculations, conduct inventory lookups, and seamlessly integrate with diverse payment methods, including credit cards, debit cards, and mobile payments. The efficiency of these terminals contributes to shorter wait times for customers and enables businesses to handle larger transaction volumes during peak periods.

Moreover, the compatibility of countertop POS terminals with various software and peripherals makes them versatile and adaptable to different business needs. They can integrate with inventory management systems, customer loyalty programs, and other software to streamline operations and enhance the overall customer experience. Additionally, these terminals can connect to peripherals such as barcode scanners, cash drawers, and customer displays, expanding their functionality and efficiency.

Mobile POS Terminals

Mobile POS terminals have revolutionized the way businesses accept payments by providing the flexibility to conduct transactions on the go. These handheld devices, often in the form of smartphones or tablets, are equipped with POS software and card readers, enabling businesses to accept payments anytime, anywhere.

One of the key advantages of mobile POS terminals is their portability. As compact and lightweight devices, they can easily be carried by business owners or staff members, allowing them to accept payments directly from customers at various locations. Whether you're operating a food truck, running a pop-up shop, or participating in events or trade shows, mobile POS terminals offer the convenience of accepting payments wherever your business takes you.

These terminals typically connect to a wireless network or utilize cellular data to process transactions. By leveraging Wi-Fi or cellular connectivity, mobile POS terminals eliminate the need for a physical, wired connection to a central system. This freedom from cables and wires enhances mobility and ensures seamless payment processing even in environments where a traditional countertop terminal wouldn't be feasible.

The POS software installed on mobile devices provides a user-friendly interface for conducting transactions. Cashiers can easily enter product information, select payment methods, and generate digital receipts for customers. Certain mobile POS solutions go beyond basic transaction processing and offer supplementary features like inventory management, customer relationship management (CRM), and sales analytics. These additional functionalities empower businesses to effectively manage their operations while on the move.

Mobile POS terminals offer a direct and engaging customer experience. With the ability to engage customers directly on the sales floor, businesses can foster personalized interactions and build stronger customer relationships. Customers can conveniently make payments using their preferred methods, whether it's swiping a credit card, tapping a contactless payment card, or utilizing mobile payment options like Apple Pay or Google Pay.

Moreover, mobile POS terminals provide real-time transaction processing and inventory updates. This instant access to transaction data allows businesses to monitor sales, inventory levels, and revenue in real-time, empowering them to make informed decisions and adjust their strategies accordingly.

Tablet-based POS Systems

Tablet-based POS systems have become increasingly popular as a contemporary and efficient solution for businesses in search of a versatile and feature-rich point of sale experience. These systems, built around tablet devices such as iPads or Android tablets, offer a range of advanced features that go beyond basic transaction processing.

The tablet serves as the central component of the POS system, running dedicated POS software designed specifically for these devices. The user interface on a tablet-based POS system is typically intuitive and visually appealing, providing an engaging and user-friendly experience for both staff and customers.

One of the key advantages of tablet-based POS systems is their versatility. These systems possess the capability to seamlessly integrate with diverse business operations, enabling businesses to streamline their processes and enhance overall efficiency. For example, these systems can seamlessly integrate with inventory management software, enabling real-time updates on product availability, automated stock alerts, and efficient inventory tracking. This integration helps businesses optimize their inventory levels, avoid stockouts, and improve overall supply chain management.

Employee scheduling and management is another area where tablet-based POS systems excel. These systems can integrate with employee scheduling software, enabling businesses to efficiently manage shifts, track employee hours, and generate payroll reports.By automating these tasks, businesses can save valuable time, minimize scheduling conflicts, and maintain precise record-keeping.

Tablet-based POS systems also offer robust customer relationship management (CRM) capabilities. They have the ability to store customer information, track purchase history, and facilitate targeted marketing campaigns. This integration empowers businesses to personalize the customer experience, offer customized promotions, and foster enduring customer relationships.

Restaurants and bars particularly benefit from tablet-based POS systems. These systems often come with features specifically designed for the food and beverage industry, such as table management, menu customization, and split billing options. Staff can take orders directly at the table, send them to the kitchen or bar instantly, and process payments efficiently, resulting in faster service and improved customer satisfaction.

Moreover, tablet-based POS systems provide advanced reporting and analytics capabilities. Business owners and managers can access detailed sales reports, track key performance indicators, and gain valuable insights into their operations. This data-driven approach allows for informed decision-making, identifying trends, and implementing strategies to drive business growth.

Self-Service Kiosks

Self-service kiosks have transformed the way customers interact with businesses by offering a convenient and efficient way to complete transactions independently. These automated POS terminals are equipped with touchscreens, barcode scanners, and card readers, empowering customers to browse products, select items, and make payments without the need for staff assistance.

Retail stores, especially those with a large product inventory, have embraced self-service kiosks as a means to provide customers with a self-guided shopping experience. Customers can easily navigate through product catalogs displayed on the kiosk's touchscreen, enabling them to browse and compare items at their own pace. By simply scanning the barcode or entering the product code, customers can add items to their virtual shopping carts, select sizes or variations, and proceed to checkout seamlessly.

Fast-food restaurants have embraced self-service kiosks to optimize the ordering process and minimize wait times. These kiosks feature user-friendly interfaces that empower customers to personalize their orders, select from a wide range of menu options, and make specific dietary choices. Customers can conveniently select their desired items, make modifications, and complete payment transactions by swiping their payment cards or using contactless payment methods.

Self-service kiosks are not limited to retail and food establishments; they are also commonly found in entertainment venues such as movie theaters or amusement parks. These kiosks enable customers to purchase tickets, select seats, and access additional services, such as concession purchases or ticket upgrades. By providing self-service options, these venues can reduce queues at ticket counters, enhance the overall customer experience, and increase operational efficiency.

One of the key benefits of self-service kiosks is the convenience they offer to customers. By putting control in the hands of the customers, businesses enable them to complete transactions quickly and efficiently, without relying on staff availability or waiting in long queues. This self-directed approach empowers customers and provides a sense of autonomy in their purchasing journey.

From a business perspective, self-service kiosks can significantly reduce wait times and alleviate congestion at checkout counters or service points. By distributing transaction processing across multiple kiosks, businesses can efficiently manage a larger influx of customers, leading to reduced wait times and heightened customer satisfaction. This increased operational efficiency can lead to higher sales and revenue generation.

Moreover, self-service kiosks can offer upselling and cross-selling opportunities. Through suggestive selling prompts, businesses can recommend complementary or upgraded products to customers as they make their selections. This can lead to increased average transaction values and boost overall sales.

Virtual POS Terminals

Virtual POS terminals, also known as online payment gateways, have transformed the landscape of digital transactions for businesses. These software-based solutions provide a secure platform for businesses to accept payments over the internet, eliminating the necessity for physical hardware in the process.

Virtual POS terminals seamlessly integrate with e-commerce websites or mobile apps, allowing businesses to accept payments from customers worldwide. By encrypting sensitive customer data during the transaction process, virtual POS terminals establish a secure channel for transmitting information, including credit card details. This encryption ensures the confidentiality of customer information and safeguards it from unauthorized access.

For businesses operating solely in the digital realm, such as e-commerce stores and online service providers, virtual POS terminals are an essential tool for conducting secure and efficient online transactions. These terminals enable customers to make purchases or payments electronically, providing a seamless and convenient experience.

One of the key advantages of virtual POS terminals is their versatility and ease of integration. They can be seamlessly integrated into existing e-commerce platforms or mobile apps, allowing businesses to leverage their existing digital infrastructure. Through this integration, businesses gain the ability to provide their customers with a diverse array of payment options, such as credit cards, debit cards, digital wallets, and various alternative payment methods.

Virtual POS terminals provide a streamlined and frictionless checkout experience for customers. By eliminating the need for customers to physically present their payment cards or enter their information manually, businesses can significantly reduce cart abandonment rates and increase conversion rates. With just a few clicks, customers can securely complete their transactions, enhancing customer satisfaction and encouraging repeat business.

Moreover, virtual POS terminals offer businesses the ability to manage and track online transactions effectively. These terminals provide detailed transaction reports, including information such as transaction amounts, timestamps, and customer details. This data can be invaluable for financial reconciliation, sales analysis, and business reporting purposes. Businesses can gain insights into their sales performance, identify trends, and make data-driven decisions to optimize their online operations.

Virtual POS terminals also offer enhanced security measures. They often incorporate fraud detection and prevention mechanisms, such as address verification systems and real-time transaction monitoring, to protect businesses and customers from fraudulent activities. These security features help build trust with customers and safeguard sensitive financial information.

Moreover, virtual POS terminals are well-suited for businesses that offer subscription-based services or recurring billing, as they have the capability to support recurring payments and subscription models. This functionality allows businesses to automate the payment process, ensuring a seamless experience for customers and providing a predictable revenue stream. This functionality automates the payment process for customers, ensuring continuity of service and providing businesses with a predictable revenue stream.

Conclusion

Here are several types of POS terminals above. Selecting the right POS terminal is crucial for your business's success. Consider your specific needs, such as mobility, business type, and integration requirements, when choosing among the various types of POS terminals available. Whether you opt for a traditional countertop terminal, a mobile solution, a tablet-based system, a self-service kiosk, or a virtual POS terminal, ensure that it aligns with your operational goals, enhances the customer experience, and provides reliable and secure transaction processing. By investing in the right POS terminal, you can optimize your business's efficiency, improve sales, and stay ahead in today's competitive market.

French

French German

German Arabic

Arabic Italian

Italian Spanish

Spanish Japanese

Japanese Persian

Persian Korean

Korean Chinese (Simplified)

Chinese (Simplified)